Bookkeeping

Lemas Accountancy offers custom bookkeeping solutions to fit the needs of your business. We view your business as dynamic and we've made our bookkeeping solutions flexible and able to adapt your needs with interchangeable services.

We can do as little or as much you would like us to do. We can train you and your staff to make bill paying, filing and storage painless. Then accurate and timely information will be produced each monthly cycle.

We have three typical models that seem to cover all of clients, but all the pieces are able to adapt to client specific needs:

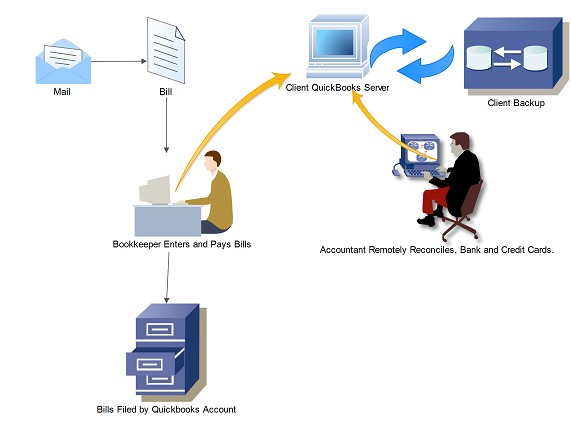

Assisted Bookkeeping: Client maintains all data on their server, pays their own bills, and has a payroll service. The client manages their own backups. We log in and assist when and where assistance is needed. Monthly or quarterly is very common in this model.

We have been using this model for over 20 years and while it still works, the Assisted model has its positives and negative attributes.

You or your Bookkeeper are in charge of:

- Pay Bills Using QuickBooks and assigning accounts.

- File your bills by vendor or expense category

- backing up your QuickBooks data

- Importing Accountant's Changes

We remote or download a file to us and:

- Reconcile all accounts not reconciled

- Clean up Accountant's Questions.

- Adjust data to tax ready financial statements

- Over see QuickBooks and make setup corrections when necessary

- Look over 1099 vendors and mark any missed and prepare at year end if not done.

- Pro: Data is completed on a business cycle, every 30 to 90 days

- Pro: Less expensive than hosting QuickBooks in the cloud

- Cons: More time in data transfer cost

- Cons: Slower turn around due to minimal access

- Cons: Errors in setup go uncorrected for long periods

- Cons: Backups are not automatic

Assisted Bookkeeping plus is Cloud Computing

You or your Bookkeeper are in charge of:

- Pay Bills Using Bill paying and filing integration with QuickBooks

- File your bills by vendor or expense category

Weconnect to the web portal for 24/7 access to your data:

- Look over 1099 vendors and mark any missed and prepare at year end if not done

- Reconcile all accounts not reconciled

- Adjust data to tax and bank ready financial statements

- Pro: Data is completed on a business cycle, every 30 days

- Pro: Data is Available 24/7 from any web enabled device

- Pro: Backups are automatic

- Pro: No data transfer\restore costs

- Pro: Can have services such as Reconciles and Tax planning on Set Dates

- Cons: Portal $150 per quarter at our cost

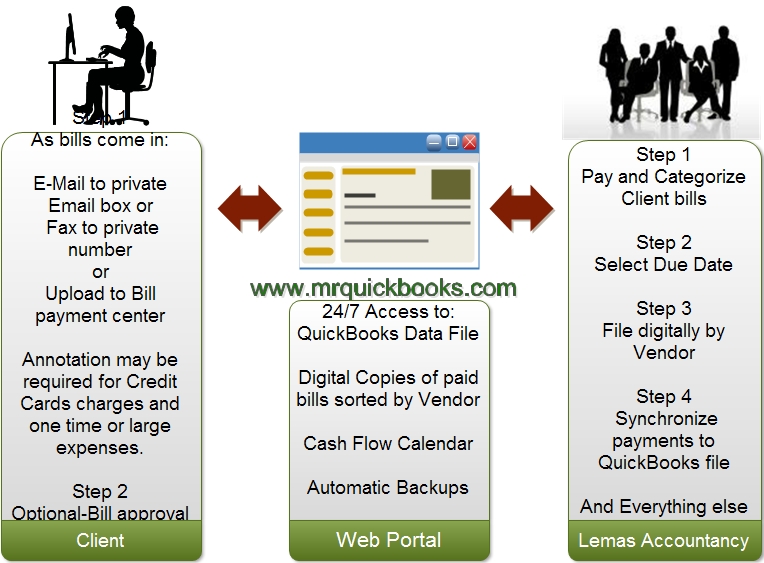

Complete Bookkeeping

You or your Bookkeeper are in charge of:

- Sending us your unpaid bills and annotating when necessary

- Answering question when they should arise about proper deduction of a particular bill

We connect to the web portal for 24/7 access to your data:

We connect to the web portal for 24/7 access to your data:

- Look over 1099 vendors and mark any missed and prepare at year end if not done

- Reconcile all accounts not reconciled

- Adjust data to tax and bank ready financial statements

- Pro: Data is completed on a business cycle, every 30 days

- Pro: Audit Proof filing system-No more filing

- Pro: Copies of bill are attached to each paid bill for reference

- Pro: Data is Available 24/7 from any web enabled device

- Pro: Backups are automatic

- Pro: No data transfer\restore costs

- Pro: Can have services such as Reconciles and Tax planning on Set Dates

- Cons: Portal $150 per quarter at our cost